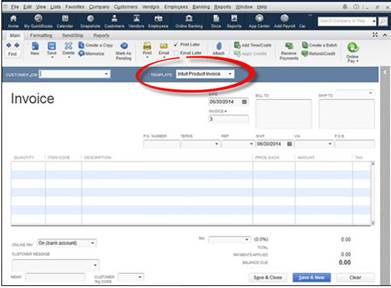

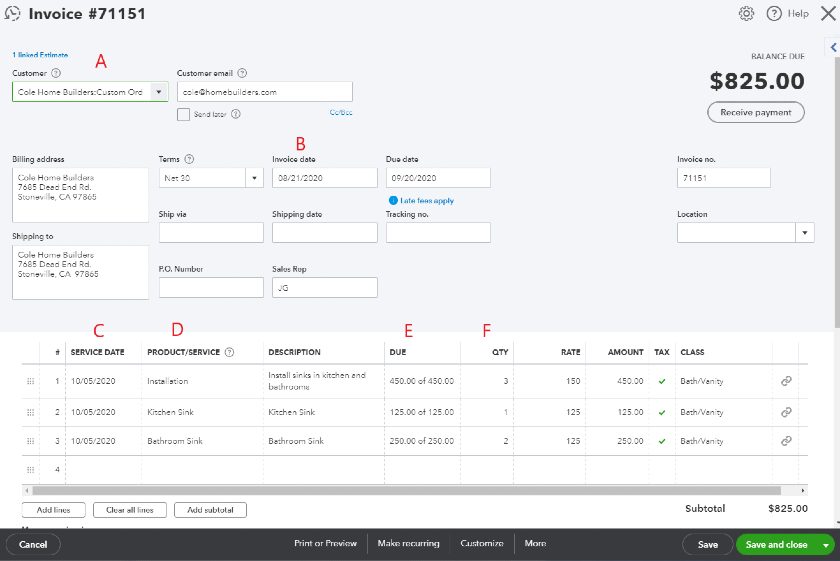

We're always here to make sure everything is taken care of. Manage Sales Tax Payments in QuickBooks Onlineĭon't hesitate to ask follow-up questions if you need more help.Learn How QuickBooks Online Calculates Sales Tax.You can see more details about this here: Understand and Set Up Sales Tax-exemptions in QuickBooks Online.įor additional guidance when collecting sales tax, I'll also share these articles with you: Scroll-down to the Sales tax section and click Edit sales tax.Look for the item and click Edit under the Action column.Go to the Gear icon and select Products and services. If you wish to change your invoice template in QuickBooks Desktop, open the List dropdown menu in the top bar.If the item itself is non-taxable, you can edit the item and edit the sales tax settings. If you only want to remove the tax on a specific line of the invoice, you can go to the Tax column and uncheck the box.

Then, select why they’re tax exempt in the Reason for exemption ▼ dropdown. Scroll-down to the Additional info section and select the checkbox for This customer is tax exempt.Proceed to the Customer Details tab, then click the Edit button in the right-hand corner.

#Invoice creator for quickbooks software

I have an item 'Down payment' as a payment. I now need to invoice the customer for a 15 down payment.

Most items, transactions, and customers are subject to sales tax. A sales order has been generated and sent to the customer.

0 kommentar(er)

0 kommentar(er)